Average retail power prices start creeping up

The Energy Research Council's (ERC's) weekly average power price benchmarks for small to medium customers in restructured states moved up last week, driven by a surge in Texas and higher natural gas prices. The national average rose 0.63% to 7.64¢/KWH.

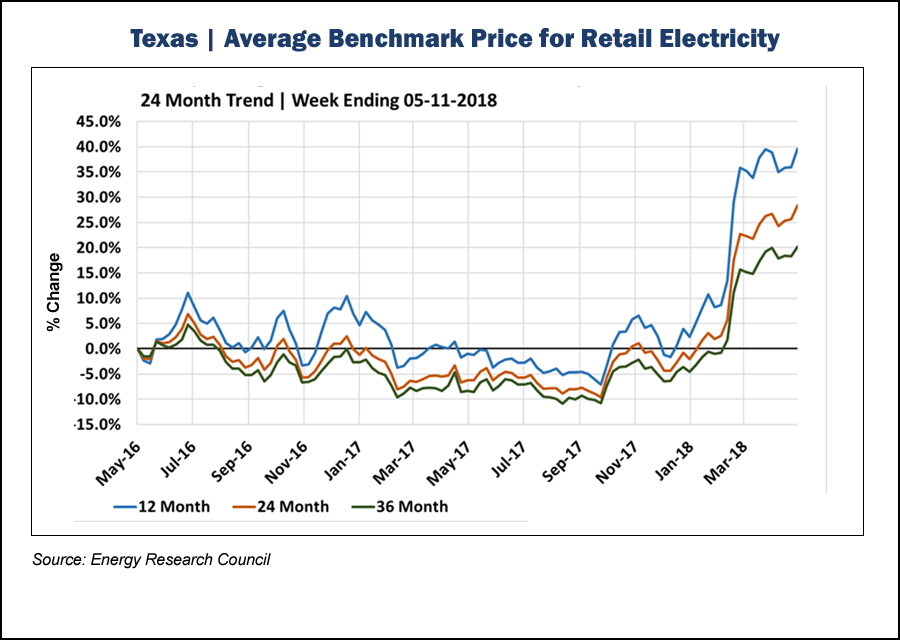

"All of the other states are fractional increases. The real increase is in Texas," ERC President James Moore told us yesterday. "Last week it popped another 5.64% and it actually brings Texas to a point where they have increased prices over 30% since the beginning of the year."

ERCOT's energy-only market is going into a summer with a reserve margin below the one-event-in-10-years industry standard for the first time. The region already saw some capacity come back online due to high forward prices as ERCOT raised its reserve margin expectation to 11% from 9.3% this summer in its most recent report (PMT, May-1), which also had a slightly lower peak demand forecast.

But prices shot up over the past month in ERCOT and last week the 5.64% boost came as the grid operator set new demand records for May last week and wholesale prices briefly spiked to $1,500/MWH Wednesday afternoon. The price spike last week was transitory but given the tight conditions after about 40% of ERCOT's coal fleet, and a large gas plant, retired – the market is expecting more scarcity pricing to come this summer, Moore said.

The average price in Texas is now 5.7¢/KWH, which is above both Ohio and Illinois. But the retail market does seem to be counting on more capacity coming online in the out years as the price for a 12-month contract is the highest at 6.1¢/KWH and every other 12-month increment drops all the way down to 4.87¢/KWH for a 60-month deal.